Is your brand prepared for the ultimate AI showdown? In 2026, the battle between Gemini 3 vs ChatGPT has moved beyond simple chat interfaces into a full-scale war for your marketing infrastructure. While OpenAI focuses on “Code Red” upgrades to maintain its creative reasoning lead, Google is leveraging a $4 trillion ecosystem to turn Gemini into the native intelligence layer for Search, YouTube, and Ads. This guide explores how to build a resilient AI marketing strategy that avoids vendor lock-in, leverages Google’s proprietary TPU hardware, and uses “Fluid Model” workflows to slash content production time from days to minutes. Don’t just pick a tool, pick a platform that compounds your competitive advantage.

The Platform War: Why This Isn’t Just About Chatbots

Most marketers are operating under a dangerous misconception. They believe they are simply choosing between two chatbots: “Should I write this blog post with ChatGPT or with Gemini?”

This is the wrong question. What you are actually doing is deciding which massive technology conglomerate gets to control your marketing costs, your execution speed, and your competitive edge. The battle of Gemini 3 vs ChatGPT is a war for infrastructure, not just text generation.

OpenAI’s “Code Red” Response

The severity of this shift became apparent the moment Gemini 3 shipped. Inside OpenAI, the atmosphere reportedly shifted to what employees called “code red” mode. To compete with the capabilities of Gemini 3, OpenAI had to make drastic pivots:

- Freezing non-essential product development.

- Pausing shopping agents and internal tool initiatives.

- Redirecting all resources toward upgrading ChatGPT to match Google’s new benchmark.

When the CEO of OpenAI reshuffles the entire product roadmap overnight because a competitor launched a superior model, it signals instability in the market. Even tech titans like Salesforce CEO Mark Benioff publicly tweeted, “I’m not going back to ChatGPT” after testing Google’s latest offering.

The Risk to Your Marketing Infrastructure

For marketing leaders, this volatility poses a massive risk to your AI marketing strategy. Think about the infrastructure you have built over the last 12 months, relying on ChatGPT:

- Custom GPTs designed specifically for ad copywriting.

- Prompt Libraries engineered for your brand voice.

- Team Training modules focused on OpenAI’s interface.

- Workflow Integrations connecting ChatGPT to Slack, your CMS, or Google Sheets.

This is all sunk cost. If OpenAI pivots, raises prices, or falls behind in capabilities because Gemini 3 vs ChatGPT has tilted in Google’s favor, your ROI on that infrastructure evaporates. Conversely, if you go “all in” on Gemini and Google alters its pricing model or deprecates a feature, you face the same “vendor lock-in” risk.

This isn’t about picking the “best” AI for today; it is about recognizing that you are making a high-stakes platform bet. Most marketers are placing these bets with zero strategy for what happens when the platform changes the rules.

The Unfair Advantage: Google’s Structural Moat

I have been predicting Google’s eventual dominance since the early hype cycle of ChatGPT. This perspective on the Gemini 3 vs ChatGPT battle isn’t born of brand loyalty, but of cold, hard analysis of structural advantages. Google possesses a ‘moat’ that no startup, not even one as well-funded as OpenAI, can easily cross.

1. The Data Supremacy

Data is the fuel of AI, and Google owns the pipeline. While OpenAI, Anthropic, and others must buy data, scrape the open web, and license content from hesitant publishers, Google is the internet for the vast majority of users.

Consider the volume of proprietary training data Google accesses daily:

- Search Intent: Every query typed into Google Search for the last 25 years.

- Video Content: Every YouTube video ever uploaded (and its transcript).

- Communication: Every email sent and received.

- Productivity: Every Google Doc, Sheet, and Slide created.

- Behavioral Data: Every click, ad impression, and Chrome browser session.

In the Gemini 3 vs ChatGPT comparison, this is the differentiator. Every one of those 13.7 billion daily searches serves as real-time training data. OpenAI is training on the past; Google is training on the now. For a robust AI marketing strategy, access to real-time consumer intent is invaluable, and Google owns that resource natively.

2. Founder Mode: The Return of Sergey Brin

When ChatGPT first launched, it was a “Code Red” moment for Google, embarrassing the tech giant and its founders. This prompted Sergey Brin, one of Google’s founders, to return to active duty.

This distinction is critical. In large organizations, bureaucracy kills speed. Professional CEOs must navigate board politics, regulatory fears, and internal approvals. Founders, however, wield an “invisible hammer.”

There are reports and podcast clips (such as discussions on the All-In Podcast) detailing Brin’s frustration with internal politics during the critical development phase of Gemini 3 vs ChatGPT. He reportedly told CEO Sundar Pichai that he couldn’t deal with the bureaucratic slowdowns and that they needed to be bypassed immediately. When a founder decides a threat is existential, hurdles evaporate.

- VP concerns about timelines? Ignored.

- Six-month approval processes? Skipped.

- Resource allocation? Immediate.

This “Founder Mode” is why Gemini 3 shipped faster than the industry expected. Google is currently iterating at startup speed despite being a nearly $4 trillion company. This agility, combined with their massive resources, makes the Gemini 3 vs ChatGPT battle incredibly difficult for OpenAI to win solely on software merit.

The Hardware War: Controlling the Physical Layer

Software is only half the battle. The physical infrastructure of the chips that process these AI workloads is where the long-term war will be won.

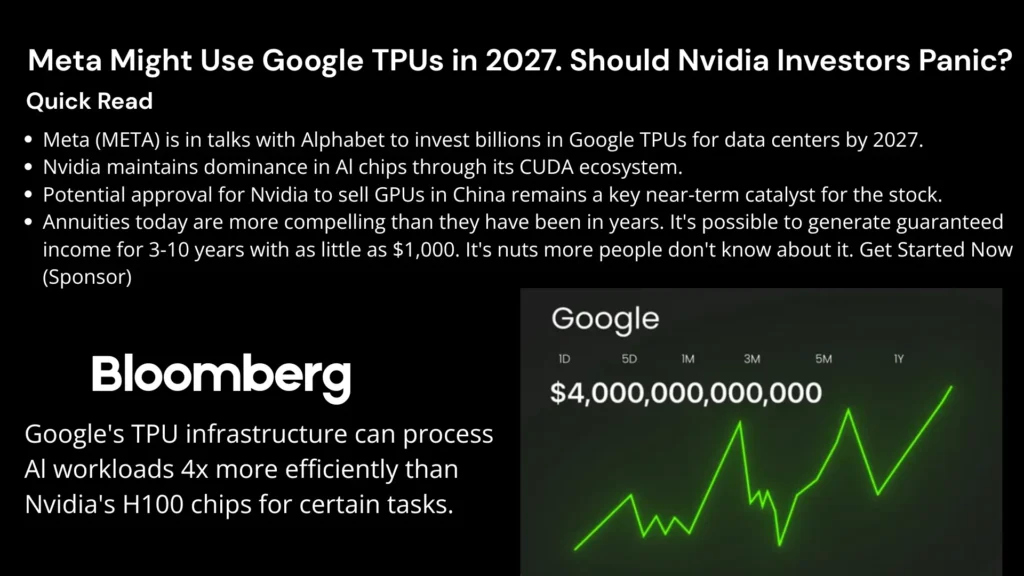

Recently, news broke regarding Meta (Facebook) engaging in talks to purchase Google’s TPUs (Tensor Processing Units) to bolster their own infrastructure in the Gemini 3 vs ChatGPT era. These are Google’s proprietary answers to Nvidia’s H100 chips. The fact that a major competitor like Meta is trying to buy chips from Google instead of Nvidia caused Google’s stock to spike and Nvidia’s to dip.

Why TPUs Matter for Your AI Marketing Strategy

According to reports from Bloomberg, Google’s TPU infrastructure can process specific AI workloads 4x more efficiently than Nvidia’s chips.

This gives Google strategic control over the entire “AI Stack”:

- The Data: Search, YouTube, Gmail.

- The Algorithms: Gemini 3 models.

- The Hardware: TPUs and Data Centers.

Contrast this with OpenAI. They are dependent on Microsoft for cloud infrastructure (Azure) and dependent on Nvidia for chips. They have a structural cost disadvantage that they cannot engineer their way out of. When you are deciding between Gemini 3 vs ChatGPT for your long-term operations, you must ask: Which company has the margins to keep winning?

Google’s vertical integration allows it to run models more cheaply and faster. For marketers, this eventually translates to lower API costs, faster generation speeds, and deeper integration into the tools you already use daily.

Key Takeaway: Infrastructure wins platform wars. OpenAI has a product; Google has an empire.

The Economics of AI: Profit Centers vs. Ecosystem Moats

While infrastructure dictates capability, business models dictate price and survival. The most profound difference in the Gemini 3 vs ChatGPT war isn’t code; it is capitalism. These two companies are playing fundamentally different games, and understanding the rules of each is essential for protecting your marketing budget.

The Business Model Divergence

Most people don’t realize that Google and OpenAI have diametrically opposite incentives. This misalignment creates a significant risk for any AI marketing strategy that relies solely on a single vendor.

OpenAI’s “Survival” Model

OpenAI charges $20 a month for ChatGPT Plus and hundreds to thousands more for enterprise API access. Why? Because ChatGPT is their business. To survive, to pay their massive server bills, and to fund future research, they need the product itself to be profitable or at least break even. They are a software vendor in the traditional sense: they sell a tool, and you pay for it.

Google’s “Ecosystem” Model

Google, on the other hand, does not need Gemini to make a single dollar of direct profit.

Let that sink in. Google is one of the most profitable entities in human history, generating over $116 billion in annual profit. This financial weight is a massive factor in the Gemini 3 vs ChatGPT landscape. According to Q3 2024 earnings data highlighted in recent industry analysis, Google’s Cloud revenue hit $11.4 billion (up 35% year-over-year), and Ad revenue soared to $65.5 billion in a single quarter.

For Google, Gemini is not a product; it is a strategic asset. Its purpose isn’t to sell subscriptions; its purpose is to keep you locked inside the Google ecosystem Workspace, Cloud, Ads, and YouTube, where they monetize you in ten other ways.

The Pricing Trap

This economic disparity creates a “pricing trap” for OpenAI.

- If OpenAI drops prices to compete, they burn through its cash runway and risks bankruptcy.

- If they raise prices to achieve profitability, they lose customers to Google’s cheaper (or free) alternatives.

Google can undercut OpenAI indefinitely. They can bundle Gemini 3 Advanced into Google One plans, offer it for free within Google Docs or subsidize the API costs using their massive advertising profits.

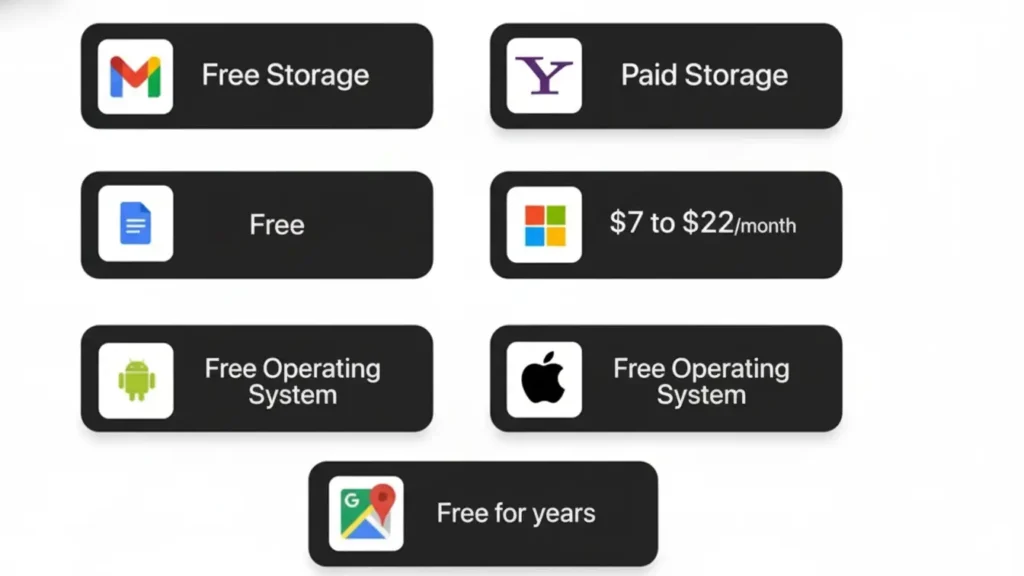

The Google “Free” Playbook: A Warning from History

We have seen this movie before. Google has a decades-long history of entering established markets with free or cheap products to destroy competitors and capture the ecosystem.

- Gmail vs. Yahoo: When paid email storage was the norm, Gmail launched with massive free storage, forcing competitors to scramble.

- Google Docs vs. Microsoft Office: Microsoft was charging $300+ for Office suites. Google launched Docs for free. Today, Microsoft has been forced to shift to lower-cost subscriptions to compete.

- Android vs. iOS: Google released a free operating system to ensure it controlled the mobile search market, undercutting paid OS competitors.

- Google Maps: For years, the API was free or incredibly cheap, killing off map competitors until Google was the dominant utility.

The pattern is always the same: Commodify the product to win the platform.

If your AI marketing strategy is built entirely on ChatGPT, you are betting that a standalone company can win a price war against a company that treats AI as a loss leader. This competitive tension is the core of the Gemini 3 vs ChatGPT debate, and it represents a dangerous financial bet for your business. If you are wrong, you may find yourself paying 2x to 3x more to stick with OpenAI or spending months rebuilding your workflows for Google’s ecosystem later.

The “Fluid Model”: Strategic Workflows for 2026

The smartest marketers I work with aren’t choosing Gemini 3 vs ChatGPT in a binary way. They are using a “Fluid Model,” leveraging both tools strategically where they are strongest. This hybrid approach gives you an unfair advantage in agility.

If you want to maximize output while minimizing platform risk, stop looking for one tool to do it all. Instead, build workflows that pass data between models based on their unique strengths.

Use Case 1: The “Nano Banana” Creative Workflow

Goal: Cut creative production time from 3 days to 45 minutes.

This workflow leverages Gemini’s real-time web access for research and ChatGPT’s superior creative nuances for copy.

- Step 1: Trend Analysis (Gemini). Use Gemini to analyze top-performing ads in your specific niche. Because Gemini is “wired into the web,” it excels at spotting current patterns and recent trends that older training data might miss.

- Action: Paste competitor assets or ask Gemini to scan current high-CTR ads in your vertical.

- Step 2: Copy Generation (ChatGPT). Take those insights and feed them into ChatGPT to generate 10 ad copy variations.

- Why? In A/B testing, ChatGPT typically produces more conversational, emotionally resonant language that performs better for direct response marketing compared to Gemini’s slightly more “corporate” tone.

- Step 3: Visual Generation (Nano Banana). Use an AI visual tool like Nano Banana (or similar high-velocity creative generators) to turn those text concepts into visual assets instantly.

- Result: You move from concept to 10 testable ad variations in under an hour, using each model for its specific “superpower.”

Use Case 2: The SEO Dominance Workflow

Goal: Create content that actually ranks in a Search Generative Experience (SGE) world.

- Step 1: Keyword & SERP Research (Gemini). Never use ChatGPT for keyword research it is hallucinating based on old data. Use Gemini. It has direct access to Google’s live index. Ask it to identify current SERP features, “People Also Ask” questions, and content gaps for your target keywords.

- Step 2: Content Drafting (ChatGPT). Feed the outline and research from Gemini into ChatGPT.

- Why? ChatGPT (specifically GPT-4 and newer iterations) tends to write with better flow, storytelling capability, and reader engagement. High engagement metrics (time on page) are critical for SEO, and ChatGPT currently wins on “readability.”

- Step 3: Optimization (Gemini). Feed the draft back into Gemini. Ask it to refine the title tags, meta descriptions, and headers based on exactly what is ranking in Google News or Search results right now. This ensures your high-quality content is wrapped in technically accurate, trend-relevant metadata.

Use Case 3: Data Analysis & Client Reporting

Goal: Turn raw data into a persuasive strategy.

- Step 1: Data Aggregation. Export your Google Analytics, Facebook Ads, and email data into a Google Sheet.

- Step 2: Analysis (Gemini). Since Gemini integrates natively with Google Workspace, you can use it directly within Sheets (or upload the file to Gemini Advanced) to spot anomalies.

- Prompt: “Analyze this weekly performance data. Identify the top 3 contributing factors to the drop in conversion rate on Tuesday.”

- Step 3: Narrative Building (ChatGPT). Take the raw insights from Gemini and ask ChatGPT to write the client-facing or executive summary.

- Why? ChatGPT is superior at “empathetic communication.” It can frame bad news constructively or explain complex data trends in persuasive, simple language that stakeholders understand.

The Human Element

While these workflows are powerful, they are not autonomous. They require a skilled team of strategists, editors, and analysts to prompt, review, and execute. Gemini 3 vs ChatGPT is not a replacement for human ingenuity; it is an amplifier.

However, as we look toward 2026, the gap between these platforms is widening. Google is embedding Gemini into everything (Ads, Analytics, Gmail), while OpenAI is deepening its “walled garden” with custom GPTs. The divergence is increasing, and with it, the “switching costs” for your business are rising.

If you don’t have the infrastructure to manage this complexity, agencies like NP Digital specialize in navigating this exact volatility for global brands. But if you are building in-house, you need to prepare for the “Platform Lock-in” that is coming.

The Cost of Inertia: Escaping the Platform Lock-In Trap

As we approach 2026, the gap between Gemini 3 and ChatGPT is no longer just a matter of which AI is “smarter.” It has evolved into a structural divide. For enterprises, the danger is no longer choosing the “wrong” bot, but becoming so deeply embedded in one ecosystem that switching becomes financially impossible.

The Divergence of 2026: Features vs. Ecosystems

While ChatGPT remains the “gold standard” for creative reasoning and human-like prose, Google has shifted the goalposts in the Gemini 3 vs ChatGPT rivalry by making Gemini 3 the native intelligence layer for the entire Google stack.

By 2026, the AI marketing strategy for most Fortune 500 companies has shifted from “using AI tools” to “deploying AI agents.” These agents don’t just write; they act.

- In the Google World: Gemini 3 agents can autonomously adjust your Google Ads budgets, rewrite meta descriptions in real-time based on live search trends, and organize your entire QBR (Quarterly Business Review) by pulling data from Gmail, Sheets, and Slides.

- In the OpenAI World: ChatGPT focuses on being a “premium powerhouse.” It offers deeper reasoning (via the o3 and o4 models), superior coding capabilities, and a more flexible API for custom-built internal applications.

The risk? Vendor Lock-in. If you spend millions training your team and building custom GPTs for OpenAI, only to find that Google’s native integration with your Search Console and YouTube data gives your competitors a 20% efficiency edge, the cost to “re-platform” could be devastating.

4 Strategic Priorities for Q1 2026

To win the Gemini 3 vs ChatGPT war, you must build for agility. Here is your roadmap for the first quarter of 2026.

1. Shift from “Tool Thinking” to “Platform Strategy”

Stop treating AI as an IT decision. This is a business strategy priority. Leadership must map out every AI dependency.

- Audit your stack: Where is your data living? If your primary customer data is in Google Cloud, Gemini 3 has a natural home-field advantage. If you are building bespoke apps on Azure, ChatGPT is likely your anchor.

- Identify Lock-in Risks: Are you building proprietary “Custom GPTs” that can’t be exported? If so, you are paying a “platform tax” in the form of lost flexibility.

2. Implement Multimodal Benchmarking

Every quarter, your team should benchmark core marketing tasks, ad copy, data analysis, and visual generation across Gemini 3 vs ChatGPT and emerging models like Claude 4.

- Don’t rely on brand preference. Use data. If Gemini 3 starts producing higher-CTR headlines for 3 consecutive months, move that specific workflow to the Google ecosystem while keeping your creative long-form content in ChatGPT.

3. Focus on AI Principles, Not Platforms

The greatest asset in your AI marketing strategy is a team that knows how to think with AI.

- Prompt Portability: Train your team to write “Platform Agnostic” documentation. Instead of an SOP that says “Go to ChatGPT and type X,” create a Master Prompt Library in a neutral environment (like Notion or a proprietary portal).

- Logic over Syntax: Teach them the logic of chain-of-thought prompting, which applies whether they are using Gemini, ChatGPT, or the next big model from Anthropic.

4. Build a Platform-Agnostic “Moat”

The most successful brands in 2026 are those that own their data. Use AI to process the data, but never let the AI own the data.

- First-Party Data is King: With the decline of traditional cookies and the rise of AI-driven search, your own customer database is your only true moat. Ensure your CRM (HubSpot, Salesforce) is the “Source of Truth” and treat Gemini 3 vs ChatGPT as interchangeable processors that plug into that truth.

Final Verdict: Who Wins in 2026?

The Gemini 3 vs ChatGPT debate doesn’t have a single winner it has a “best fit” for your specific business model.

- Choose Gemini 3 if your business is data-heavy, relies deeply on the Google Workspace ecosystem, and needs real-time integration with Search and YouTube for performance marketing.

- Choose ChatGPT if your priority is creative excellence, high-end copywriting, complex reasoning, and building custom, developer-led automation tools.

In the end, platform agility is your greatest competitive advantage. AI is improving exponentially, not linearly. If you are locked into one vendor, you are at the mercy of their roadmap. If you are platform-agnostic, every breakthrough in the industry, whether from Mountain View or San Francisco, makes your business faster, cheaper, and better.

Stop asking which AI is better. Start building a marketing engine that wins no matter which AI is on top.

FAQs:

Q1: Which is better for SEO in 2026, Gemini 3 or ChatGPT?

A: While ChatGPT is often cited as the better tool for writing humanized, engaging blog content, the Gemini 3 vs ChatGPT comparison reveals that Gemini 3 has a significant edge in SEO research. Because it is natively integrated with Google Search and Search Console, Gemini provides more accurate real-time keyword data and SERP (Search Engine Results Page) analysis. A winning AI marketing strategy often involves using Gemini for research and ChatGPT for the actual creative writing.

Q2: Is Gemini 3 cheaper than ChatGPT for businesses?

A: Generally, yes. Because Google uses Gemini as a strategic asset to drive users into its $4 trillion ecosystem (Ads, Cloud, Workspace), they often bundle it or offer lower API costs in the Gemini 3 vs ChatGPT price war. OpenAI’s primary revenue comes from ChatGPT subscriptions, meaning they have less room to lower prices in a competitive landscape compared to Google’s diversified revenue model.

Q3: Can Gemini 3 access my Google Workspace data?

A: Yes, this is one of its primary “wins.” In the context of Gemini 3 vs ChatGPT, Gemini 3 can pull information from your Gmail, Google Docs and Sheets to provide contextually relevant answers. However, businesses must ensure they have “Enterprise” privacy settings enabled to prevent their sensitive internal data from being used for general model training.

Q4: Is ChatGPT still the leader in creative writing?

A: As of late 2025/2026, most benchmarks and user sentiment reports regarding Gemini 3 vs ChatGPT still favor ChatGPT for creative storytelling, brand voice consistency, and “emotional” copy. While Gemini 3 is more factual and structured, ChatGPT’s advanced reasoning models (o-series) provide a nuance that currently feels more “human” to readers.

Q5: How to protect your business from the AI Ecosystem Trap?

A: To keep your AI marketing strategy agile, store your prompts and workflows in a platform-neutral document. Avoid building core business logic exclusively inside “Custom GPTs” or specific platform features that don’t allow for data export. Always maintain a “Fluid Model” where you can switch your API provider, especially when evaluating the shifting landscape of Gemini 3 vs ChatGPT, with minimal disruption to your team’s daily tasks.